Interest Rate News

November in Lake Tahoe has shaped up with good news for our local economy. We’ve had a nice base of snowfall and the ski resorts opened early. More snow is on the way through the first week of December. The 2022/2023 ski season is off to a great start!

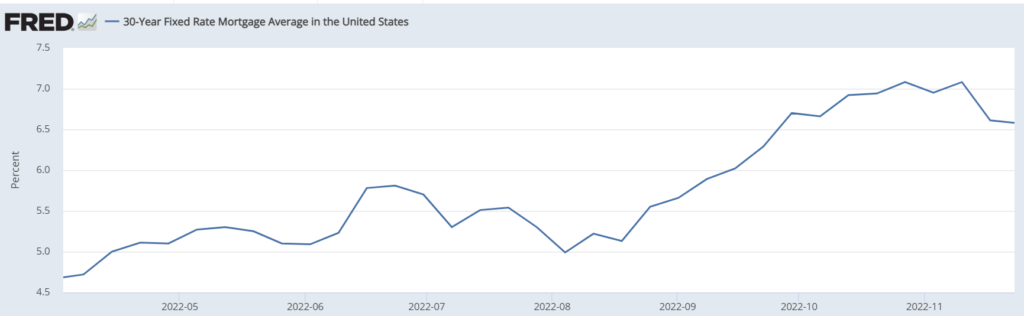

Additionally, during November, we began hearing good news about interest rates for the first time since the spring. The FED has been consistently increasing rates, many times even 75 basis points! They are attempting to curb inflation, while not creating a recession. With news in October that inflation may finally be dropping, the next rate hike is expected to be much lower.

This has led to more optimism in the stock market and an increase in loan applications. On November 9th, rates rose as high as 7.14%. With news of lower inflation numbers, rates fell below 7%, down to 6.9% on November 16th. Today, the interest rate for a 30-year fixed-rate mortgage is at 6.78%.

For the week of November 18th, mortgage applications rose 2.2% for the first time in months. The FED will meet again in December and is expected to announce perhaps, a 50 basis point hike. For the last four months, they have raised it 75 basis points each month, so this is good news.

The FED expects to peak rates to just under 5% and hold them there throughout 2023. This should stabilize the real estate market, if we can get used to interest rates in th 6-7% range. Projections from their September meeting, implied peak rates may fall between the 4.5% to 5%. The current FED rate is between 3.75% to 4%.

Lenders work upwards from that starting point. This is why a rate at 6.78% seems to be increasing loan applications. It may be that rates settle around 7% or higher in 2023, so this is an excellent time to get a loan if you have been waiting.

This surge in interest rates has crippled the housing market, with home prices starting to drop because borrowing costs are higher. A 1% change in the interest rate can change the monthly payment in a way that borrowers qualify for a purchase price that is much lower than what they could afford last year.

During the pandemic, rates were reduced to almost 0%, and interest rates were between 3% and 4%. Over the last 2 years, we have experienced the highest inflation numbers in four decades. The consumer price index revealed that prices were up 7.7% year-over-year in October, compared to 8.2% in September.

Inflation has remained higher than expected, but appeared to be slowing down in October. The November numbers are not in yet, and will influence what the FED does in terms of rates in December.

While we are not in a traditional buyer’s market – buyers definitely have the upper hand in the market. Sellers will need to ensure their homes are priced well and in good showing condition. Inspection and other contingencies are no longer being waived.

Contact me today to learn more about the Lake Tahoe and Truckee real estate market. Wishing you and your family a wonderful holiday season.