Good News for Homebuyers - Rates are Declining

Mortgage rates dropped for the fourth consecutive week, indicating they may have peaked. This has enticed many homebuyers from the sidelines.

At the end of October, rates were as high as 7.79%. Today, the average rate on the 30-year fixed mortgage declined to 7.29% from 7.44% the week prior, according to Freddie Mac. This amounts to a half point decline over one month.

After consistently raising their rate .25 basis points each month in 2023, the FED has kept their rate steady since August. In the November meeting, they indicated that they may be done with raising rates.

The stock market, which reacts to changes in the monetary policy, has continued its November rally and the S&P 500 exited correction territory. This is good news for the luxury real estate market as many investors move their gains into these types of assets.

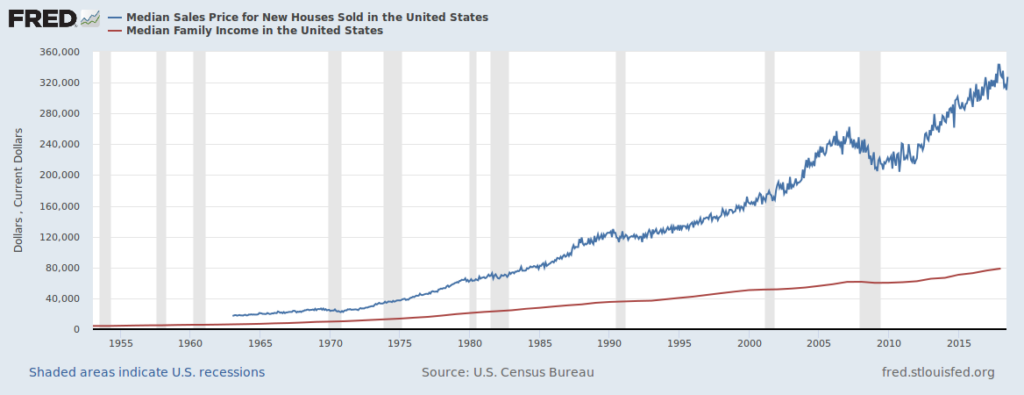

When considering buying a home, interest rates may fluctuate, but home prices always grow in the long term. This graph shows the steady growth of US Median home prices since 1955. It is interesting to note that Median Family Income has not grown as dramatically. The best investment anyone can make is buying real estate and holding it over time.

Some forecasters predict that rates may drop into the 6% range in 2024. This would lead to a flurry of buyers, although home prices would rise even higher with demand. Currently, we have only a 3 month supply of inventory, so this is an excellent time to list your home for sale.

As a buyer, this would be a good time to get your finances in order to be ready to make an offer as rates are declining.

Choosing to buy a home based on timing low mortgage rates isn’t always good. Many would-be buyers today, probably wish they hadn’t waited when rates were in the 5% and 6% range. Over the long term, home prices will continue to appreciate, while refinancing can be an option if and when rates come down in the future.

According to the Mortgage Banker’s Association, mortgage application volume increased 4% week over week. U.S. bond yields moved lower, another sign that the economy is more robust and that inflation has cooled. Mortgage applications rose to their highest level in 3 weeks.

Contact me today for more information about the Lake Tahoe real estate market.